Strategic Advisory Analytics – Series #2: Gene Therapy – Near-term Revolution or Continued Evolution?

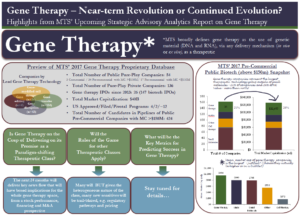

MTS Health Partners, L.P. will be publishing its second series of Strategic Advisory Analytics reports “Gene therapy – Near-term Revolution or Continued Evolution?” in the coming months. The full report will be published in three parts: (1) Global proprietary data – Key valuation and performance data from MTS’ database of 189 global public and private gene therapy companies (2) Ecosystem – Description of the gene therapy space, the various technologies, and current business models, as well as analysis of the potential impact of approvals and launches on the biopharma industry (3) Conclusions – Provide key insights and potential actionables in order to help management teams and investors successfully navigate the coming era of gene therapy. Today we are publishing a snapshot of our work in the attached mini deck. (Link)

The first Series of our Strategic Advisory Analytics reports on Drug Pricing can be accessed at http://www.mtspartners.com/investment-banking/news/.

Will the next 24 months be a revolution or continued evolution of the gene therapy era?

Gene therapy, i.e. the treating, and potential curing of diseases at the genetic level is “the final frontier” of therapeutic technologies and arguably could revolutionize medicine a magnitude greater than small molecules, and more recently, biologics have done during the last 100 or so years. Whilst the conceptual approach of treating/curing diseases at the fundamental genetic level is clearly attractive and has attracted therapeutic intervention approaches that date back to the 70’s, relatively few gene therapy drugs have made it to the market and the field has largely remained one of hope and potential. Concomitantly, given the complex science and regulatory environment, progress in gene therapy has been more evolutionary than revolutionary from a commercial perspective. However, the revolution in gene therapy commercial success could be just around the corner. Before the end of 2017, we expect approval decisions for at least three gene therapy candidates (Spark’s vortigene neparvovec, Novartis’ CTL019 and Kite’s axicabtagene ciloleucel) – more decisions for this therapeutic category in one year than in any previous year.

Because of its potential, gene therapy has attracted significant investment: Our proprietary database of global public and private biotech companies reveals some interesting observations:

- Globally there are 189 pure-play gene therapy companies

- There are 54 public pure-play gene therapy players, with a total market capitalization of ~$40B

- Since 2013, 26 of the 147 biotech IPOs have been for gene therapy companies, which cumulatively raised a total of $2.8B

- Gene therapy dominates the pre-commercial space – of the 162 public pre-commercial companies with market caps above $150M in our database, 34 are pure-play gene therapy companies, the largest category outside of small molecules

- Public pre-commercial gene therapy companies have a combined market capitalization of $32B, which is roughly 26% of all the value ascribed to the public pre-commercial biotech industry

- Moreover, the mean market capitalization of pre-commercial gene therapy companies ($956m) is more than monoclonal antibodies ($800m) and small molecules ($795) companies.

As the title of our report points out, the real question is whether gene therapy is finally ready to revolutionize medicine or if more evolution of this therapeutic class is necessary? As we flag on slide #2 of the mini deck and the figure, there are many questions that need to be answered over the next two years in order for us to declare a gene therapy revolution. In particular, we will be paying close attention to key news flow (think regulatory decisions), as well as broader sector indicators, such as financings and M&A activities. Additionally, given the heterogeneous nature of gene therapies, many new sensitivities with respect to regulatory pathways, manufacturing and pricing will need to be trailblazed, and will be key factors for initiating and maintaining a gene therapy revolution. Stay tuned.

* Note that we define gene therapy as the use of genetic material (DNA and RNA), via any delivery mechanism (in vivo or ex vivo), as a therapeutic.

We welcome comments and questions to the coordinating author, Ravi Mehrotra (mehrotra@mtspartners.com) and/or to any of the Partners at MTS.