Feedback #4 on Principled Drug Pricing Report: Orphan Drug Pricing – Unlikely to be Left Alone in the Current Drug Pricing Debate

Bottom line:

- In our conversations around the current drug pricing debate, the vast majority of investors and companies we have talked to think orphan drugs, more accurately speaking “ultra-orphan” * drugs, are immune to pricing pressure relative to “mainstay” drugs (*we have subjectively defined ultra-orphan drugs as those that treat rare disease with “truly” less than 10,000 patients vs. 200,000 for technically orphan drugs).

- This view is due to the perception that: (a) ultra-orphan drugs don’t move the needle on the totality of drug spend and (b) the unwillingness of denying access to “essential” drugs for ultra-orphan populations. Both of these perceptions are not an accurate reflection of the reality.

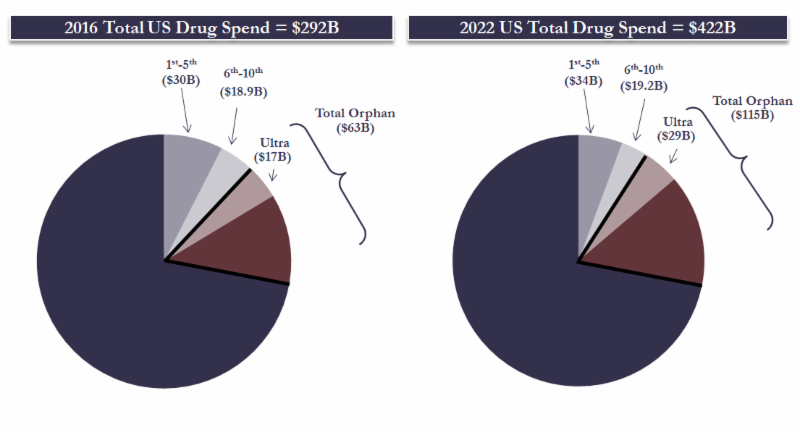

- We provide analysis that ultra-orphan drugs ARE (increasingly becoming) a needle mover. In totality ultra-orphan drugs accounted for ~$17B or ~6% of the total US drug spend in 2016. This is set to grow to ~$29B or 7% by 2022. If we use the official definition of orphan drugs, they accounted for 21% of US drugs sales in 2016 and are estimated to grow to 27% by 2022.

- Recent news flow on the last three approved ultra-orphan drugs around limited reimbursement, and/or stricter utilization controls, illustrates that there IS increasing willingness to limit access to orphan drug – quod erat demonstrandum.

- Compounding the above two factual observations is the arguable lowering of the clinical effectiveness hurdle for some recently approved orphan drugs. The majority of companies we have spoken to take this view with the focus of blame for this “travesty” ironically being leveled at the patronus or guardian of clinical effectiveness, the FDA.

- Ultra-orphan drugs are priced in a tightly correlated two dimensional plot of addressable population size and price. Proven clinical effectiveness is seemly not a third dimensional axis. Thus ultra-orphan drugs are currently priced based on a “what the market can bear” fashion. We have previously argued this is the same pricing methodology for mainstay drugs, and one which is unsustainable.

- In conclusion and in our view (1) ultra-orphan drugs are NOT immune in the current drug pricing debate – many of the sensitivities with the “mainstay” drug pricing debate will likely spill over into the ultra-orphan drug arena; (2) whilst the future of ultra-orphan drug prices will obviously not be value based, some level of clinical utility (in addition to just population-based pricing) will likely be required; and (3) although there is little current evidence of this happening anytime soon, there are some arguments for modernization of the 1983 Orphan Drugs Act.

Please find the mini deck associated with this Orphan Drug Pricing note here (link).

We welcome comments and questions to the coordinating author, Ravi Mehrotra (mehrotra@mtspartners.com) and/or to any of the Partners at MTS. You can now follow us on Twitter – @MTSpartners.

We published our first “Strategic Analytics” report “Principled Drug Pricing Centered on Innovation and Choice: Part 1” (link) in November 2016. As we highlighted at the time, the principal purpose of the report was to act as a forum for debate on this important contemporary societal issue. With this in mind, we continue to communicate the key feedback items post our continued interactions with both investors and corporates. Feedback #1 related to the likely impact of the new administration on drug pricing (link), #2 related to the impact of drug price rises (link), and #3 related to the frictional costs in the US drug ecosystem (link). In this 4th feedback note we discuss orphan drug pricing and its perceived immunity from the drug pricing debate.

Details:

Based on our conversations with both investors and companies it has become evident that the general thought process is that ultra-orphan drugs are the most immune to pricing pressure in the current US drug pricing debate (the antithesis of specialty drugs). The overall reasoning behind this line of thinking is: (a) that despite the high prices of ultra-orphan drugs they really don’t move the needle in the overall US drug budget due to low patient numbers and (b) the unwillingness of denying access to “essential” drugs if they are available. In our view, both of these bastions of current common beliefs are under threat of changing and orphan drug prices are far from immune in the drug pricing debate.

(1) Orphan drugs don’t move the overall drug spend needle. Really? There is a limit on “society’s ethical insurance premium” – it feels like we are close to it.

If you walk up to a person on the street and tell them that for every $100 they spend on drugs (either directly or via insurance premium), 1% or $1 goes towards paying for drugs to treat a very small number of patients that suffer from ultra-rare diseases, that person is likely to say that is fine, 2%, still fine, 3% probably still fine, etc, etc– we term this “society’s ethical insurance premium”. If you repeat the same question but say that for $100 they spend on drugs, 25% or $25 is going towards paying for orphan drugs, the response is likely to be very different –Our point here is that at some proportional point of total drug spend, society (and payers) will push back on the totality of spend on ultra-orphan drugs – i.e. societies insurance premium comes at too high a cost. Thus the key questions are: (a) what % of total drug spend is currently, and in the future, spent on (the totality) of ultra-orphan drugs, and concomitantly (b) where is the “pushback point”?

What is the totality of spend on Ultra-orphan drugs?

So dealing with the % of total drug spend on ultra-orphan drugs, the factor to address here is what is an ultra-orphan drug? Technically an orphan drug in the US is defined “as those intended for the safe and effective treatment, diagnosis or prevention of rare diseases/disorders that affect fewer than 200,000 people in the U.S., or that affect more than 200,000 people but are not expected to recover the costs of developing and marketing a treatment drug”. In the EU the definition is similar with the numerical being “affecting not more than five in 10,000 people in the European Union”. Under these official orphan criteria the majority of approved orphan drugs would not be considered “subjectively really orphan” drugs by those “skilled in the art” and include drugs such as Revlimid, Avastin, Herceptin, Opdivo, Keytruda, Pomalyst, etc. Thus, the debate about orphan drug pricing is really about ultra-orphan drugs for which there is no official definition. For the historians amongst us the term ultra-orphan was first introduced by the UK’s National Institute for Health and Care Excellence, aka NICE (aka “not-NICE” as better known by many in the biopharma industry) in 2004.

Using our database of 257 drugs approved in the US under orphan drug status, which are actively marketed and with material revenues, we subjectively categorized ultra-orphan drugs mainly based on the widely accepted criteria as those treating less than 10,000 patients. Using this methodology in our screen, there are 72 ultra-orphan drugs, which account for ~27% of the total marketed US orphan drugs in 2016. Putting hard number on these ultra-orphan drugs, they represent around ~$17Bn or 6% of the 2016 US total drug spend, which is projected to grow to $29Bn or 7% by 2022. As an interesting note – all orphan drugs (i.e. those officially classified as orphan) represent around $63Bn or 21% of the 2016 US total drug spend and are projected to grow to $115Bn or 27% by 2022. We return to the topic of orphan vs. ultra-orphan later in this note in this note.

Where is the pushback point for ultra-orphan drug spending as a proportion of total drug spend?

So is a 6-7% spend on ultra-orphan drugs (of the total US drug spend) nearing a pushback point? There clearly is no definitive answer, but here are some considerations:

- a) In our conversations with companies and investors when we asked people to guess the % spent on orphan drugs (we did not touch on the subject of orphan vs. ultra-orphan in our questioning) most estimates were in low single digit region.

- b) The ~$17Bn of cumulative sales of the 72 ultra-orphan drugs in 2016 is around the cumulative sales of the 5th to 10th of the top 10 selling drugs in the US in 2016.

- c) As we pointed out in our original tome on the drug pricing debate (link), the totality of all US drug spend is just 2% of US GDP and 10% of total healthcare expenditures – these are small numbers yet we are in the middle of a drug pricing debate…

(2) No one should be denied access to the “essential” drugs if they are available….Is the clinical bar for orphan drugs getting lower?

There is no justifiable ethical pushback for allowing patients access to a drug that “works” and where there is no alternative. The points made above simply question the potential economic barriers to broader ultra-orphan utilization. Having said this, it is notable that there has been increasing public debate over a number of more recent orphan drug approvals that have questioned the “efficacy” element (e.g. link, link, link, link). This has led to access denial by some insurers or at least stricter utilization controls over and above the approved labels/populations. Not wanting to get drawn into the specifics of “are these orphan drugs really efficacious” (a topic by itself), our key points here are (a) there IS increasing willingness to limit access to orphan drug – quod erat demonstrandum, and (b) we would argue the central reason for this emerging access limitation is the combination of ultra-high prices for ultra-orphan drugs and a questionable lowering of the clinical effectiveness hurdle rate for approval. To add to this is the general (mainstay) drug pricing debate and the casting of biopharma companies as “bad ones”. Altogether this culminates that for the first time ever we are starting to see the once sacrilegious subject of the limitation of ultra-orphan drug access being publically debated.

Going forward this situation is only likely to be amplified rather than go away. In our view, the one key factor that the biopharma industry can address (and ultimately will have to) is the observation that ultra-orphan drugs are priced in a tightly correlated two dimensional graph of addressable population size and price. Proven clinical effectiveness is seemingly not a third dimensional axis. Thus the current method of pricing ultra-orphan drugs based on a “what the market can bear” fashion. We have previously argued this is the same pricing methodology for mainstay drugs, and one which is unsustainable (Feedback #2: Unprincipled Price Rises – Where is the Value in an Unbearable Symptom – link).

(3) Derivative thoughts on ultra-orphan drugs

Three fundamental reasons that underpin high orphan drug prices over and above the commercial reality of needing to charge high prices for drugs which address small populations.

The first is that orphan drug therapeutic modalities are often “proving grounds” which can be applied to drugs for broader populations. For example, many of the first oligonucleotide and gene therapy drugs were/are being used initially in orphan drug settings, with clear intentions to move out to broader indications.

The second is that many first generation orphan drugs with modest clinical efficacy are “stepping-stones” for the next generation drugs that are likely to have a more meaningful clinical benefit. The classic example is Orkambi, which has a modest 4% FEV. However, the future of cystic fibrosis treatment is most likely to be a “triple combo” of some sort, which will have a more meaningful clinical effect but arguably would not have been developed if the utility of a corrector and potentiator had not been shown with Orkambi.

The third reason is the social reason, and the original reason why the Orphan Drug Act exists — that developing orphan drugs is the “right thing” to do. Without a doubt patients and caretakers of patients affected by rare disease feel grateful and inspired that companies have chosen to study, often for decades at a very high cost, devastating diseases that affect only few people in the world.

An increasing focus on repurposed mainstream drugs for orphan disease – distinguishing between justified risk/reward and gaming the system

A scan of the increasingly negative PR on orphan drugs shows a number of articles centered around mainstream drugs that have been repurposed for orphan populations. More than 450 drugs have been approved since the enactment of the Orphan Drug Act in 1983. Of these 73 or around 16% have previously been marketed for the masses and then repurposed for orphan drug populations where they were subject to very significant price increases. Furthermore, a number of drugs that were first approved in an orphan indication were originally developed for mainstay diseases (but ultimately failed in these indications). This begs the question is the repurposing of mainstay drugs for orphan indications simply “gaming” the orphan drug incentives, and thus further highlighting “bad actors” in the drug pricing debate.

In our view, in the majority of cases, the answer is no – far from it. A vibrant orphan drug industry requires commercial, as well as regulatory incentives (see below). Commercial incentives mean financial compensation that is proportional to the risks taken in the development of the drug. For the vast majority of repurposed orphan drugs the scientific and monitory risk was not materially changed just because the drug has been used or developed in a previous mainstay indication. A prime historical example being thalidomide, which was originally introduced for morning sickness in the late 1950s with the much now documented side effects that resulted in its withdrawal from the market in the 1960s. But without the pioneering work and investment by Celgene (scientific credit to Judah Folkman), Thalomid would have not been developed for hematological cancers. Indeed Thalomid is the bedrock for the IMiD-lead paradigm shift in living with, rather than dying of, multiple myeloma (yes, the next IMiD, Revlimid, is now the gold standard but is unlikely to have been developed if not for Thalomid – a prime example of a “stepping-stone orphan drug” as discussed above). There are more recent examples of mainstream drugs being developed in orphan indications with the highest quality science, development and financial resources being deployed with the aim of treating truly debilitating diseases – e.g. Ovid’s OV101 for the potential treatment of Angelman and Fragile X syndrome formally known as Lundbeck’s Gaboxadol that was originally developed as an insomnia drug in the 1990s.

The majority of the emerging bad PR around orphan drugs is where there has been (arguably/optically or in reality, depending on your view) modest new R&D investment in the orphan element for a low cost (frequently generically available) mainstream drug. This type of ultra-orphan drug results in pricing (and financial reward) that is asymmetric to the risks and costs of development and arguably should indeed be a focus for the public, regulatory bodies and the biopharma industry itself. The key to any resulting changes should be not to discourage, but rather encourage, the development of “true value-added repurposed” ultra-orphan drugs.

The future of the ultra-orphan drug industry – is modernization of the 1983 Orphan Drugs Act needed?

There is no doubt that the 1983 enactment of the Orphan Drug Act and its concomitant incentives (e.g. research grants, a 50% tax credit for development costs, seven years of market exclusivity and waived regulatory fees) acted as a significant founding catalyst for the orphan drug industry. Arguably the next biggest catalyst was in the mid-90s and the pioneering business model of Genzyme, and its then CEO Henri Termeer, who in the words of another biotech hero* (Stelios Papadopoulos/The Godfather) “showed us how to build a business by treating rare diseases, in the process creating a new pricing paradigm but making sure no patient was left untreated because of a financial hardship”. The point here being that both regulatory incentives and commercially tenable business model incentives were needed to create the vibrant orphan drug industry we have today. (* for further “Biotech hero’s” please refer to slide 76 from our original deck “Principled Drug Pricing Centered on Innovation and Choice: Part 1” (link) in November 2016).

Returning to some thoughts about the original 1983 Orphan Drug Act, given the incentives laid out in the Act, it was clear that these were based on the broad assumptions, including (a) many/most orphan drugs would be repurposed mainstream drugs – hence the orphan exclusivity, and (b) orphan drugs were unlikely to be commercially incentivized drugs – hence the tax credit and waived regulatory fees. As discussed throughout this report, the orphan drug industry has come a long way over the last 34 years, with most orphan drugs being novel, most of them (ultimately) treating more than 200,000 patients, and the industry having an attractive commercial entity (arguably more attractive than “mainstay” drugs). This begs the question of should we see a modernization of the 1983 Orphan Drug Act to better address the current ultra-orphan drug market. For example, a focus on true ultra-orphan diseases and longer exclusivity periods for “true value-added repurposed” ultra-orphan drugs (with the possible swapping out of the tax incentives/ waived regulatory fees).

Finis.

We welcome comments and questions to the coordinating author, Ravi Mehrotra (mehrotra@mtspartners.com) and/or to any of the Partners at MTS.

For media inquiries please contact Argot Partners:

Andrea Rabney

212.600.1902

andrea@argotpartners.com

Eliza Schleifstein

917.763.8106

eliza@argotpartners.com